This article shows you how to reconcile the parts inventory in Orion

At the end of each month you should be reconciling your parts inventory to your general ledger in Orion to ensure there are no balance mis-matches.

You will have to confirm with your accountant which GL codes are used in order to balance. !!! YOUR SYSTEM'S CHART OF ACCOUNTS IS UNIQUE!!!

The support team are unable to give you accounting advice or conduct the reconciliation for youReconciling a Cost Of Sales system is extremely difficult, this is due the parts sales being recorded by part number while the GL is recorded by creditors invoice, therefore there is no easy way to cross reference.

TABLE OF CONTENTS

- Identify the Month(s) out of balance

- Stock Valuation Report

- Statement of Financial Position (Balance Sheet)

- Identify the Transaction(s)

The Process

- Identify the month(s) out of balance

- Identify the transaction(s) out of balance

Identify the Month(s) out of balance

A big difference here is if you are balancing each month:

- If you balance each month then you will only need the Current Month/Period

- If you are not, then most likely you will first need to confirm which month first was out of balance -

using the Totals button from the Balances history is the easiest for this

Compare

- Stock Valuation Report to

- Statement of financial position (Balance sheet)

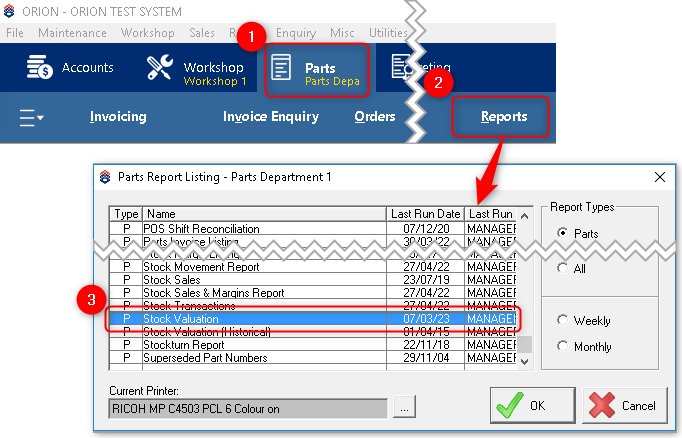

Stock Valuation Report

You will need to print this report for each department being balanced

Current as at when printed:

This prints the valuation for the Parts department you are in You may need to print a valuation per department

The purpose of this report is to identify if the month doesn't balance - not to get any details

1. Can be sorted by any means

2. IF unticked then there will be one total figure - Ticked will show each part and its value as well.

Historical

Historical Stock Valuations can be printed from two locations:

Report

Enter how many months ago and click on OK

Archived reports

To find the archived reports folder see this article

We are looking for one of the following reports:

The Parts_StkValSummary report will show a total of all parts departments

IF also reconciling Workshop parts then also look for the following:

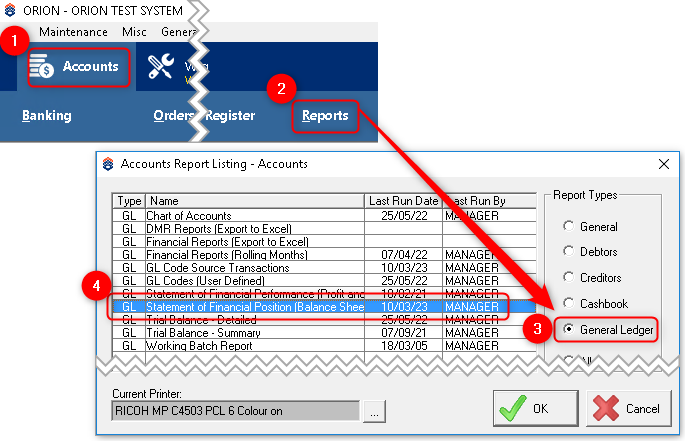

Statement of Financial Position (Balance Sheet)

This can be done by going into the Accounts module (1) > Reports (2) > General Ledger (3) > ‘Statement of Financial Position (Balance Sheet) (4)

Confirm with your accountant which GL codes are used in order to balance. !!! YOUR SYSTEM'S CHART OF ACCOUNTS IS UNIQUE!!!

3. You are able to Drill down and see the detail of the figures

4. Send to can export the figures to a file

It is advisable to create an excel spreadsheet to help you reconcile for a range of periods.

This will allow you to establish when the parts inventory and GL have become mismatched. below is an example

| Period | GL | Sub-Ledger | Difference |

|---|---|---|---|

| March | |||

| April | |||

| May | |||

| June | |||

| July | |||

| August | |||

| September | |||

| October | |||

| November | |||

| December | |||

| January | |||

| February | |||

| March |

Identify the Transaction(s)

Reconciling a Cost Of Sales system is extremely difficult, this is due the parts sales being recorded by part number while the GL is recorded by creditors invoice, therefore there is no easy way to cross reference. Try the following

Reconcile using a detailed report to find out which individual transactions do not match.

To do this you will need the following two reports:

- GL Source Code Transactions &

- Stock transaction

GL Source Code Transactions

In the Accounts module (1) go to Reports (2) > General Ledger (3) > GL Code Source Transactions (4)

Enter the parts inventory GL code (1) and the period which is an issue, tick Detailed (2) and you are able to export to excel as well (3).

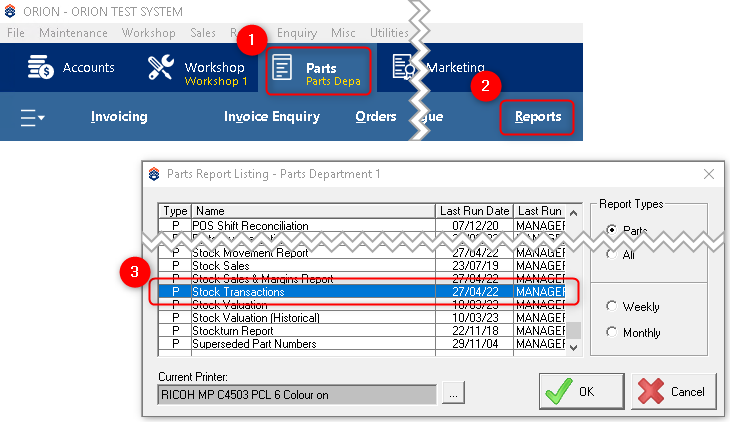

Stock Transactions

In each Parts module (1) go to Reports (2) > Stock Transactions (3)

Select the correct date range (1) (e.g. the month of the mismatch) and export it to excel (2).

- You will then need to reconcile the general ledger transaction to the stock transactions.

This can be done by either manually marking off each transaction (you can use the reference number and amount when reconciling) or use excel formulas to compare the two different spreadsheets. - Once found try and identify why the transaction(s) were posted and correct individually.

E.g. a manual journal created against the parts stock account might result in a transaction being present in the GL report but not the parts stock transaction report. This journal may need to be reversed. - After completing this reconciliation, you can give our helpdesk a call to discuss your findings.

please note that the helpdesk is unable to give you accounting advice or conduct the reconciliation for you.Didn’t find what you were looking for?

Our Support team are here to help, you can reach us by submitting a support ticket